Introduction

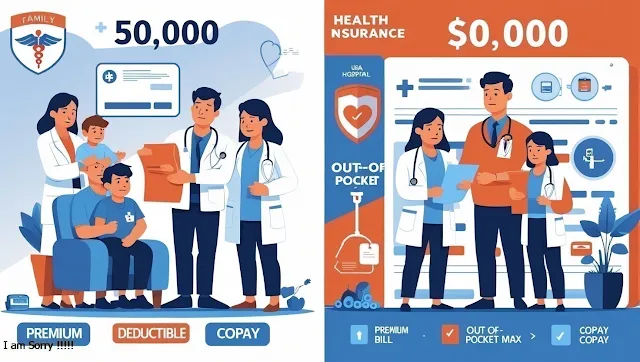

Imagine you suddenly have a searing pain in your chest. You go to the emergency department, where treatment alone will cost you $50,000. This nightmare is what awaits people who do not hold health insurance leverage. Medical costs in the USA can single-handedly leave families bankrupt, and it goes on to validate that health insurance is more than just a security blanket.

The purpose of this guide is to present a comprehensive overview of the methods concerning health insurance in the USA, particularly in the circumstance where a user enrolls for the very first time, switches plans, or plans pts to comprehend the concepts surrounding health insurance. Understanding the concepts of health insurance will enable users to secure their physical and financial wellbeing.

1. An Overview of Health Insurance in the USA

Health Insurance Definition and Its Uses

Every citizen in the USA has the option to purchase health insurance, meaning they can choose a specific healthcare provider that accepts their plan. Each provider has its terms, conditions, and rules, which are subject to frequent change.

Financial Protection: This encapsulates expensive treatments, surgeries, and emergency procedures.

Preventive Care: Offered by virtually all plans are complimentary check-ups, immunizations, and preventative screenings.

Legal Requirement: Most individuals are required to have coverage as per the Affordable Care Act (ACA); otherwise, they will incur a penalty (the penalty is currently $0 federally).

How Does Health Insurance Work?

With enrollment, you acknowledge the following payment commitments:

Premiums: The monthly payment made to maintain coverage under a specific health plan.

Deductibles: This is the amount you must pay before your insurance makes any reimbursement of expenses.

Copayment & Coinsurance: The agreement where one undertakes to meet part of the bill remaining after payment of the deductible.

Out-of-Pocket Maximum: This refers to the maximum sum of money that may be spent in a year. After reaching this limit, the insurance covers all expenditures.

Example: If the insured has a plan that has a $2000 deductible, $2000 will be added for 20% coinsurance, in which case the member must initially incur $2000, but after that, is clear of 20% of the other expenses until the out of pocket maximum is met.

2. Types of Health Insurance Plans in the USA

Employer-Sponsored Health Insurance

This is the most likely affordable option if your job provides health benefits.

Health Maintenance Organization (HMO) offers the lowest monthly premium but places restrictions on consulting an expert until a referral is received.

Under Preferred Provider Organization (PPO), there are no restrictions on contacting out-of-network providers. However, such contacts carry excess charges.

The Exclusive Provider Organization (EPO) accepts no out-of-network providers except in emergencies.

Point of Service (POS) plans incorporate features of both HMO and PPO plans. A referral is needed to see a specialist; however, some use of out-of-network providers is allowed.

Marketplace ACA Individual and Family Plans

Individuals who lack access to employer-sponsored insurance can obtain a plan from Healthcare.gov or their state's marketplace. This choice comes with the following advantages.

Premium Tax Credits: Applicable lower-income subsidized federal help based on family size and income.

Basic Health Services: The ACA provides minimum hospitalization and prescription care, along with other maternity and mental healthcare services.

Government Health Insurance Programs

Medicare: For individuals 65 years or older or those with specific disabilities.

Part A: No premium cost Hospital Insurance.

Part B: Medical Insurance, around $170 a month. Covers most of the doctor's visits.

Part C (Medicare Advantage): This includes additional services offered by private health insurance companies.

Part D: Covers benefits associated with prescription drugs.

Medicaid: A healthcare plan that is free or very low-cost to eligible low-income individuals (eligibility differs by state).

CHIP (Children's Health Insurance Program): Health coverage for children from families with income above Medicaid limits but still below average.

Short-Term Plans and Catastrophic Plans

Short-Term Plans: For those currently uninsured and who need coverage for a short period (1-12 months).

These plans are less expensive but are not regulated by the ACA, which means they do not cover pre-existing conditions.Catastrophic Plans: Also known as high-deductible plans, these require a consumer to spend a certain amount of their own money to access the plan. Accessible to those under 30 years old or those with qualifying hardship exemptions.

3. Highest Considerations When Selecting a Health Insurance Plan

Coverage and Benefits

Every plan has so much to offer, so make sure to check:

Are the network providers your physician, medications, and specialists?

Is emergency services, mental health, and it's prenatal care included?

What is the exclusion of cover?

Costs Breakdown

| Factor | What to Check |

|---|---|

| Monthly Premium | Is this a long-term goal that you can afford? |

| Deductible | How much do you need to spend before cover begins? |

| Copay/Coinsurance | What is your charge per doctor visit or Rx? |

| Out-of-Pocket Max | What is the worst-case annual cost? |

Network Restrictions Are

Lower costs, in return limited to in-network doctors: HMOs

More costs in return for the ability to see specialists with no referrals: PPOs

4. Ways to Spend Less on Health Insurance

Practical Cost-Cutting Actions

✔ Annual Plan Evaluation: Ensures you get value for your money, as prices can vary. Check during the open enrollment period for new deals.

✔ Request for Subsidy: If you earn less than 400% of the federal spending line, you might be able to receive some financial assistance for your premiums.

✔ Open an HSA: Available only to those enrolled in a high-deductible plan. This account allows tax-free dollars to be set aside for medical expenses.

✔ Remain Within the Network: Use doctors within your network to eliminate additional medical service expenses.

Blunders to Avoid

❌ Never Read Finer Text: Determining if you have a service is equally as important as selecting the plan. Some cover reasonable services but do not assist other crucial ones.

❌ Overlooking Cost-Effective Care: Addressing problems before they escalate and require more resources. This can be achieved through no-cost screenings.

❌ Waiting Until You Get Sick: You cannot enroll on a whim; enrollment waiting requires pre-planning.

5. How To Enroll In Health Insurance

When Are You Able To Enroll?

Enrollment period: From November 1st to January 15th, enrollments are covered under the ACA.

Special Enrollment Period: Enrollment is possible within 60 days due to qualifying life events.

Enrollment guide to walk you through the process

You must have social security cards with corresponding coverage documents and income verification.

Use the tools on healthcare.gov to compare the plans by doctor's visits, coverage, and expenses.

Apply for Income-Based Discount – answer the income questions as mandated to verify eligibility for a lower payment.

Submit Application - online, by telephone, or with the assistance of an in-person assister.

Pay Premiums: Coverage begins after the first payment is made and processed.

Conclusion

The plan takes a preventative approach to security, offering comprehensive Health Insurance that includes treatment, check-ups, and numerous visits. Hashing it through an employer, the ACA Marketplace, or specific government programs helps limit expenditures while enhancing the quality of care.

Take control of your wellbeing and financial wellbeing today. Act now before time runs out.

Most Frequently Inquired Questions: Health Insurance in USA

1. Which one is the most effective health insurance?

The best health coverage is that which caters to your individual health needs and financial capability. Generally, Employer plans tend to be the most affordable, whereas ACA plans are better suited for freelancers and financially strained families.

2. What is the average cost of health insurance a month?

Employer plans: Monthly $100-$500 (shared between employer and

employee)

ACA plans: $0-$400 monthly (with subsidies)

Medicare: $0-$200+ per month (depending on the chosen parts)

3. Am I eligible to obtain insurance if I'm unemployed?

You absolutely can! Some of the options that are offered to you are:

Marketplace insurance (subsidized by ACA)

Medicaid (Income and needs-based)

COBRA (extension of employer plan for 18 months post-termination)

4. What happens if I decide not to get insurance?

You won't incur any federal fines, but you will have to pay for any medical services needed, which may leave you in debt or unable to receive necessary medical treatment.

5. What other plans can I change?

Any changes can be made as of January 1st every year.

Post a Comment